Hydrogen Council and global consultancy McKinsey & Company releases a state of the industry report, Hydrogen Insights 2022.on the actual hydrogen market development today and actions required to unlock hydrogen at scale.

This report has three sections:

Momentum: Industry announcements show current investment momentum in the global hydrogen industry.

Actual deployment today offers unique insights into the real deployment of hydrogen across sectors and geographies.

Priority actions for policymakers & industry suggest a set of priority actions for policymakers and industry for the coming year to overcome the key challenges preventing hydrogen deployment at scale.

1.Momentum: Industry announcements

The pipeline of hydrogen projects is continuing to grow, but actual deployment is lagging.

In 2022, 680 large-scale project proposals worth USD 240 billion have been put forward, but only about 10% (USD 22 billion) have reached final investment decision (FID). While Europe leads in proposed investments (~30%), China is slightly ahead on actual deployment of electrolyzers (200 MW), while Japan and South Korea are leading in fuel cells (more than half of the world’s 11 GW manufacturing capacity).

2.Actual deployment today

Clean hydrogen deployment is increasing across the value chain.

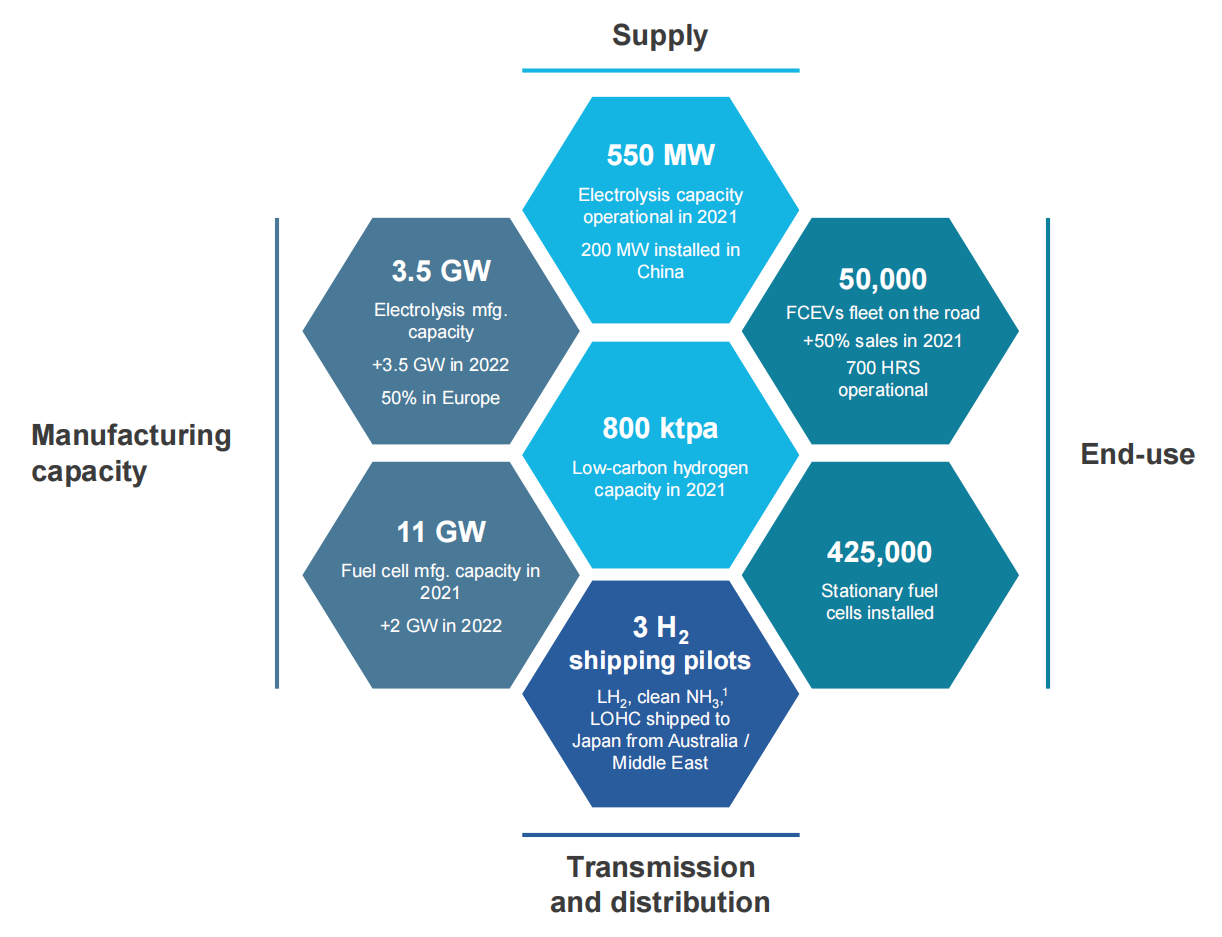

The deployment of hydrogen technologies and projects is gradually growing across the value chain, with progress in hydrogen supply, transmission and distribution, and end-uses in the past year as shown below.

(1) Hydrogen supply: 800 kt low-carbon, 550 MW electrolysis deployed

Up until now, the global industry has installed about 800 kilotons (kt) per annum of low-carbon hydrogen capacity and about 550 MW of water electrolysis for renewable hydrogen supply. Operational low-carbon hydrogen volumes are spread across 18 projects, with about 90% of the capacity in North America. Installed electrolyzer capacity grew about 80% from 2020 to the end of 2021, with most of the growth (160 MW) in China. China is currently the world’s largest market for electrolysis, with about 200 MW capacity installed (most of which involves a 150 MW plant commissioned in 2021). Europe is the second-largest market with about 170 MW of electrolyzers installed (with 40 MW added in 2021). About two-thirds of this serve demand from industrial end-uses such as ammonia plants or refineries, followed by mobility at about 10% of total capacity.

About 75% of the installed electrolyzers are alkaline technology, followed by proton-exchange membrane (PEM) solutions, which account for most of the remaining 25%. Most PEM electrolyzer capacity is installed in Europe, while other regions have higher shares of alkaline technology.

(2) Hydrogen transmission and distribution: Initial steps to develop a hydrogen trade system are being taken

Global seaborne hydrogen trade is slowly evolving. Small-scale deliveries of clean hydrogen by ship have taken place. Three pilot projects carrying clean ammonia, liquid hydrogen, and liquid organic hydrogen carriers (LOHC) have already sailed in the past three years, delivering hydrogen from Australia and the Middle East to Japan.

Other regions are starting to focus more on hydrogen trading as well. European countries are considering imports from several potential export countries in the Middle East, Northern Africa, and elsewhere, while Singapore is considering importing hydrogen from Australia. Several regions are positioning themselves as exporters of renewable or low-carbon energy, including Australia, Latin America, North America, Northern Africa, and the Middle East.

Hydrogen pipelines are advancing. There is about 4,500 km of hydrogen pipeline installed globally, transmitting grey hydrogen to industrial end-users, showcasing the feasibility of transmitting hydrogen via pipelines. Several initiatives are currently exploring pipeline transmissions of hydrogen. For instance, pipeline exports of hydrogen from energy resource-rich areas in Northern Africa or Norway to continental Europe are being considered, while the UK and California, among others, are testing the blending of hydrogen in natural gas pipelines.

The deployment of hydrogen refueling stations continues to grow. About 700 hydrogen stations were installed globally by the end of 2021, reflecting about 25% annual growth from the end of 2020. About half of these are in Japan, South Korea, and China, with about 100 stations added in the past year, reflecting annual growth of about 35%. Europe accounts for about 230 stations, while the US has 80 operational stations concentrated in the coastal states. Annual growth in these two markets was about 20%, notably slower than in Asian markets.

(3) Hydrogen end-use: 65% growth in vehicles, clean ammonia producers lead in industry segment

Hydrogen is advancing in mobility.Sales of fuel cell vehicles grew by about 65% from 2020 to 2021, with total sales of about 17,000 vehicles (up from 11,000 in 2020). Commercial vehicles account for about 10% of total vehicle sales, with about three-quarters consisting of fuel cell buses and the remainder of trucks. Sales of fuel cell passenger vehicles grew about 80%, totaling about 15,000 vehicles sold worldwide in 2021. Most sales were in South Korea (55% of sales), North America (20%), and Japan (15%). Progress is happening with off-road vehicles as well, where hydrogen has a role to play for heavy,long-duration uses in sectors like mining, construction, or rail. Multiple projects have retrofitted mining trucks with fuel cells, while OEMs have developed crawler excavators that run on hydrogen. Hydrogen-fueled trains were deployed in several countries in Europe and Asia. More than 10 trains currently operate globally, with orders for over 60 more in place.

Industrial hydrogen end-uses have high activity levels, but large-scale plants have yet to be built.27 renewable hydrogen projects have reached FID, of which about 20 are in Europe. Among these, ammonia leads the way with seven projects having reached the FID stage and three operational projects (up to 20 MW electrolyzers). Meanwhile, clean methanol production projects are maturing, with seven at the FID stage and the largest operational plant having a 10 MW electrolyzer. Another five renewable hydrogen projects focus on refining, four small-scale projects target hydrogen-based steelmaking, and four others will produce synthetic fuels. However, no full-scale plants have reached the FID stage.

Energy and heating end-uses are progressing.Examples include the blending of hydrogen in natural gas turbines as well as the development of hydrogen-ready turbines and hydrogen for high grade heat applications, as well as the replacement of coal with clean ammonia in power plants. Notably, Japan and South Korea have deployed combined heat and power (CHP) fuel cell systems that can run on hydrogen, with about 425,000 such systems installed across Japan.

(4) Technology suppliers have ramped up manufacturing capacity

Electrolysis.Companies have installed about 3.5 GW of electrolysis manufacturing capacity globally by the end of 2021, with another 3.5 GW announced to be added during 2022. European OEMs have developed about half of the existing capacity, while Chinese OEMs have announced the most ambitious targets for 2022 and are planning to install an additional 1.5 GW this year. Two-thirds of existing capacity is atmospheric alkaline technology today, whereas the share of pressurized electrolyzer technologies should gradually increase as new manufacturing capacity rolls out.

Fuel cells.The currently installed fuel cell manufacturing capacity is approximately 11 GW, with about 60% of this capacity developed by South Korean and Japanese OEMs, followed by Chinese and American OEMs. Announced near-term growth is limited, with a target of 13 GW total installed capacity in 2023, and most growth will occur in South Korea.

Vehicle platforms.Vehicle OEMs have developed 87 fuel cell vehicle platforms to date, up from 61 in 2021 (about 70% are in China). Most of the current platforms are for fuel cell buses, followed by trucks and light vehicles. Most of the new platforms target fuel cell trucks, followed by light vehicles such as vans or passenger vehicles.

3.Priority actions for policymakers & industry

Joint action by the public and private sectors is urgently required to move from project proposals to FIDs.

Both governments and industry need to act to implement immediate actions for 2022 to 2023 – policymakers need to enable demand visibility, roll out funding support, and ensure international coordination; industry needs to increase supply chain capability and capacity, advance projects towards final investment decision (FID), and develop infrastructure for cross-border trade.