At the beginning of this year, the World Intellectual property Organization (WIPO) released a detailed report entitled "Hydrogen Fuel Cells in Transportation". In the report, the distribution and trend of the patent in the hydrogen fuel cell transportation sector is analyzed in detail from the macro and micro, national and international perspectives.

Fuel cells, especially hydrogen fuel cells, have continued to receive increasing attention in recent years as one of the varieties of alternative clean energy technologies, and are expected to be a solution to reducing carbon emissions in the transport sector. Fuel cells can directly or indirectly convert the hydrogen stored in the container into electricity, thereby driving numerous tools in the transport sector. In theory, during the operation of hydrogen fuel cells, no greenhouse gases (GHG) are produced during the operation, with only water and heat being produced as by-products (as well as the electrical output).

The road transport sector needs to decarbonize and dramatically lower emissions. This is necessary not just from a regulatory perspective, but also because only a truly sustainable transportation and automotive industry will be able to maintain its importance and prosperity in the long term.

However, moving to a net-zero emission future creates crucial challenges for the automotive industry. Fossil fuels, which have been used for hundreds of years, are still the mainstream energy supply method on the market, it is not an easy task for the entire automotive industry shift to low-carbon or even zero-carbon emission in a short term. Among the current mainstream alternatives, battery electric vehicles (BEVs) and FCEVs powered by hydrogen are the most prominent and promising ones on the market.

Hydrogen is light, storable, and energy-dense, and its use as a fuel produces no direct emissions of pollutants or greenhouse gases. Because of this unique characteristic, hydrogen is considered a strong contender to replace existing fossil fuels in the future. To date, hydrogen use in the entire transportation sector has been limited to a less than 1 percent share of the total global stock of vehicles. However, the fuel cell vehicle market is beginning to take off, catalyzed by developments in hotspots like East Asia, the United States, and the European Union, more than 40,000 fuel cell vehicles were on the road globally by the end of June 2021. Global fuel cell vehicle deployment has been concentrated largely on passenger vehicles.

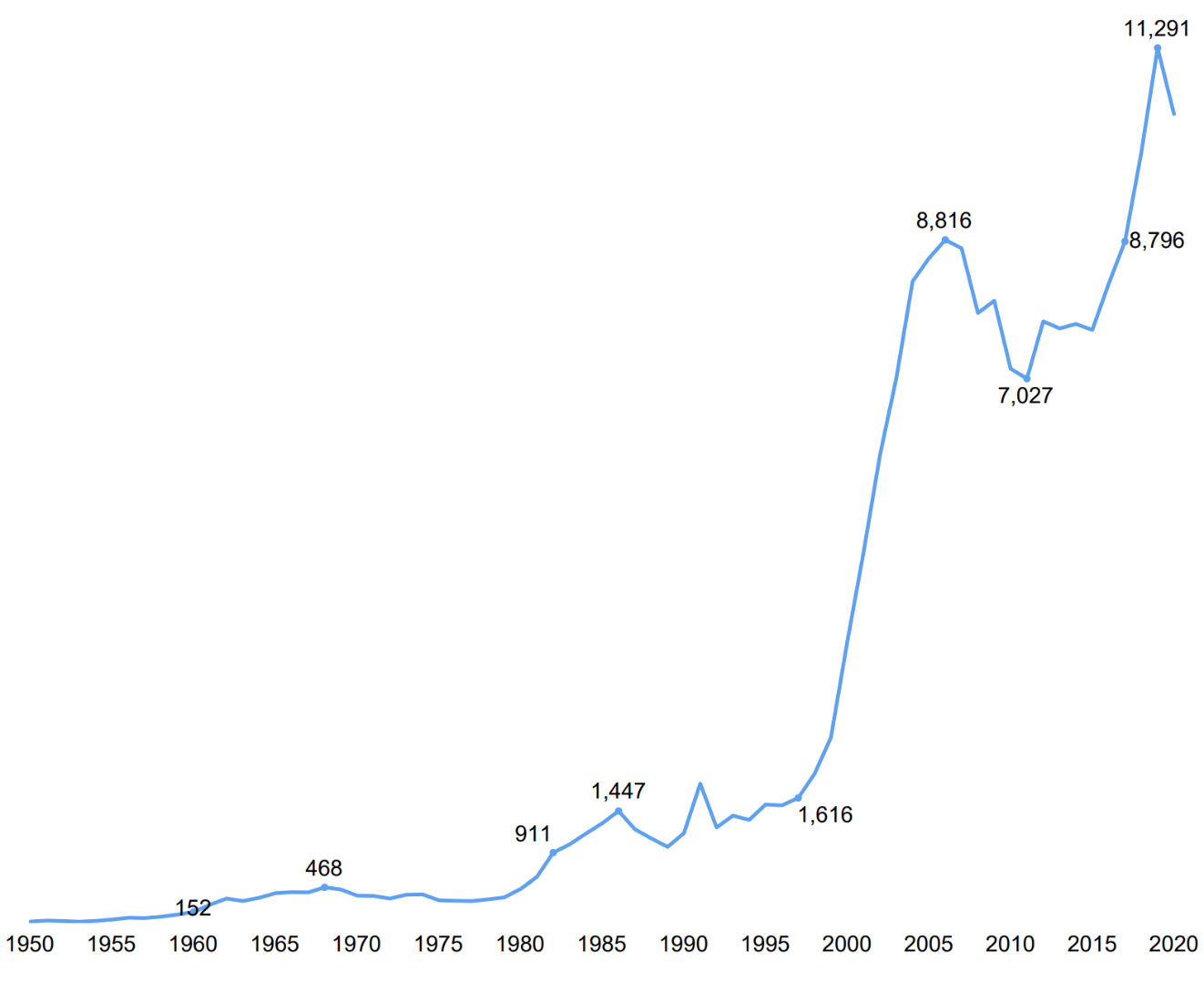

Figure 1 below, illustrates the general trend of patent filing in the field of fuel cells between 1950 and 2020. The data used to plot Figure 1 is not limited to fuel cells in the transport sector specifically. We can see from the figure that the patent filings are generally increased from 1950 to around 1980, followed by a period of high growth from 1980 to the end of the 1990s. A sharp rise in fillings followed between 2000 and 2005, before it slowed down in around 2010, but a further sharp rise occurs in around 2016. Figure 1 below suggests that significant fuel cell innovation has occurred since around the year 2000. It can be expected that the number of patent filings related to fuel cells will continue to increase as global efforts are focused on meeting strict emissions deadlines in the coming years.

Figure 1 - Fuel cell patent filings by year of filing (1950-2020) [source: Figure 5 of WIPO report "Hydrogen fuel cells in transportation"]

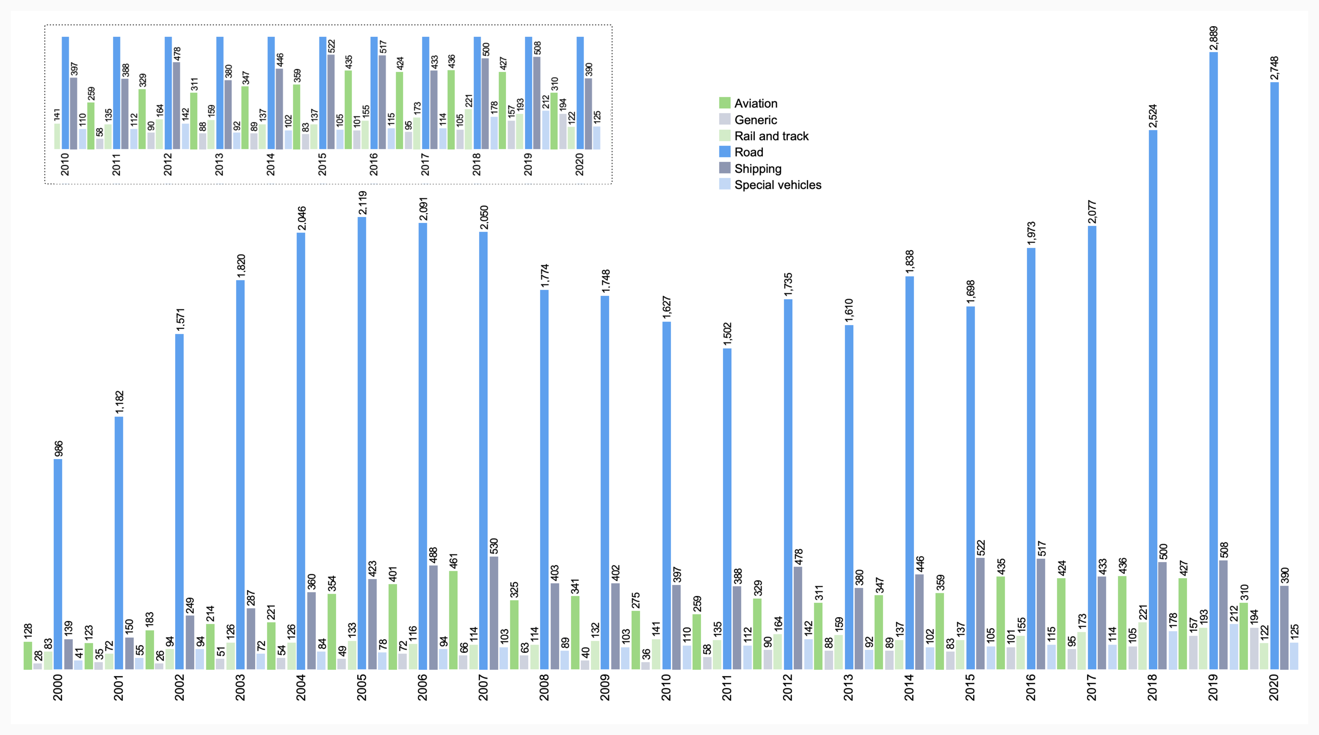

For the purpose of this report, WIPO divided patents across the sector into six categories to better show what the trend looks like, these categories are: road vehicles, including specific analyses of trucks and commercial or cargo road vehicles; rail and track-side vehicles; shipping and water-side transport; aircraft and other air-side vehicles, such as vertical take-off and landing (VTOL) or drones (unmanned aerial vehicles, UAVs); and a great variety of special vehicles, this could include a collection of different typical commercial vehicles, including fork-lifts, airport tugs, tractors and dredgers, and various constructions vehicles; Finally, there remained a category of patent documents that did not belong to any of categories that mentioned above. Figure 2 shows the development of these six application fields over time. It is clear to see that the road vehicles represent by far the largest field of application, leading developments and defining trends in transport sector, followed by shipping and rail applications.

Figure 2 - Fuel cell patent filings by transport subsector [source: Figure 21 of WIPO report "Hydrogen fuel cells in transportation"]

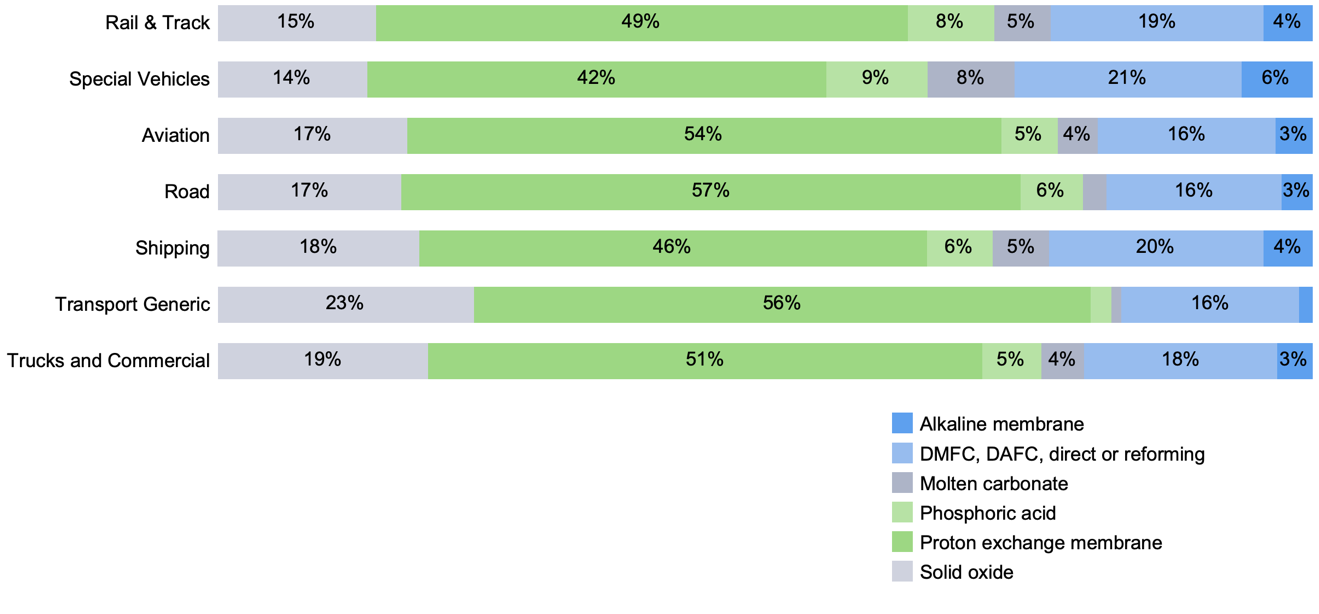

Figure 3 is the distribution of patent filings related to various fuel cell types across different areas of transportation. The data used in the figure includes all active and inactive fuel cell related patents, classified by the six application fields proposed above, we can clearly see that the dominance of PEMFCs (green) is visible over time. SOFCs (light grey) are typically in second place, with reformer/DMFCs/DAFCs (light blue close to the end of the graph.

Figure 3 - Distribution of patent filings related to various fuel cell types across different areas of transportation [source: Figure 13 of WIPO report "Hydrogen fuel cells in transportation"]

In all transport applications, PEMFCs were found to be the most commonly used fuel cell type, with a share above 50 percent in nearly every application field. In shipping, trucks, and rail and track is there a slightly higher share of SOFCs, amounting to close to 20 percent. The highest share for reformers/crackers is in special vehicles (21 percent), followed by shipping (20 percent) and rail (20 percent). This suggests a greater acceptance of alternative fuels, such as methanol or ammonia, in these generally more industrial sectors. Both solvents are already common in industrial environments, such as harbors. Shipping and rail are also comparable to stationary setups, with generally larger installations and typically requiring greater reliability and longer durability.

Trends in China's recent fuel cell-related patent applications:

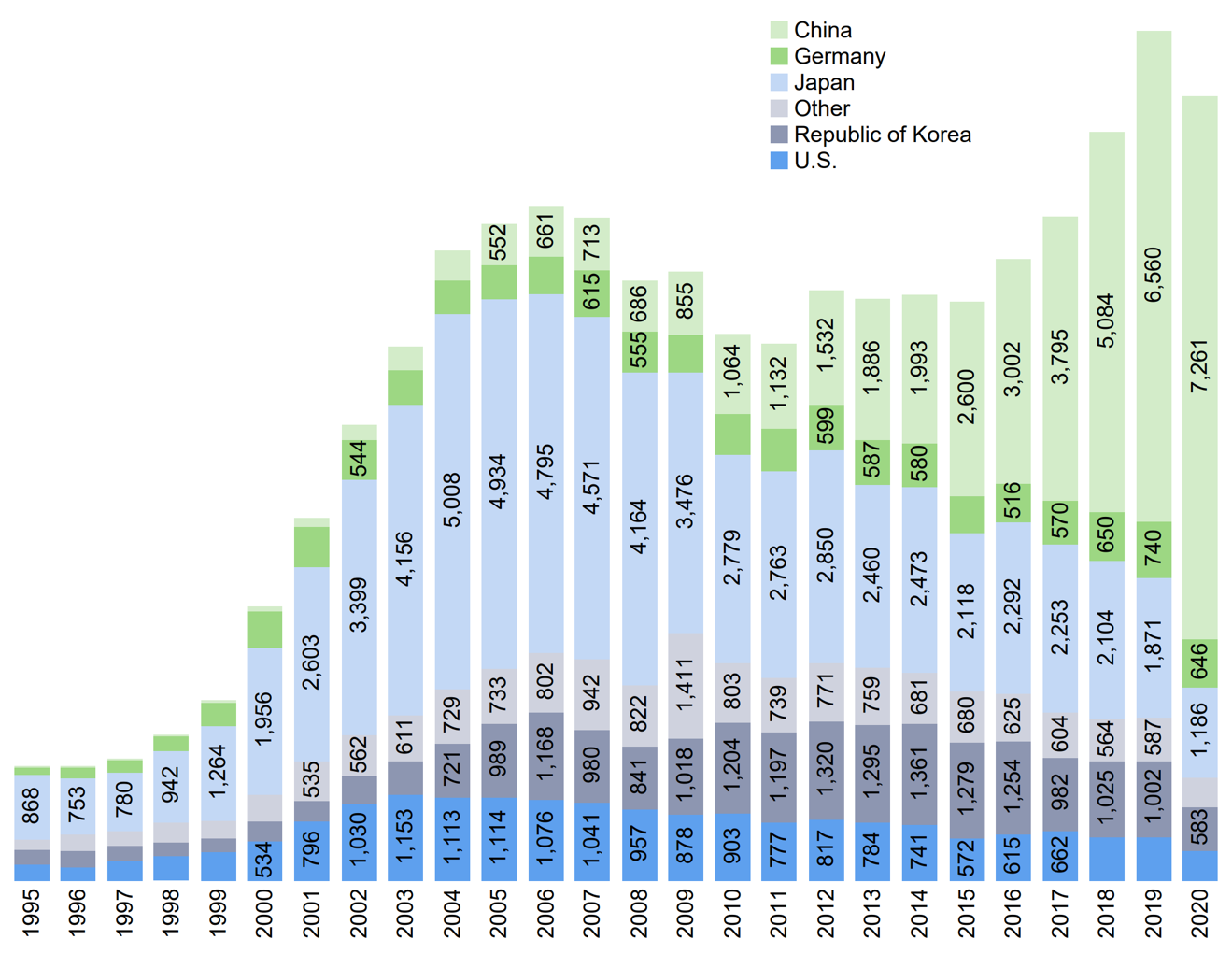

Shown in figure 4 are fuel cell patent filings by inventor location, it is a breakdown of the number of fuel cell patent filings by five key locations of inventors: China, Germany, Japan, Republic of Korea, and the United States (and all other territories). The visualization graph illustrates that inventors based in China contributed to significant growth in filing numbers since around 2010, going on to overtake the previously largest contributor to fuel cell technologies by inventors based in Japan.

Figure 4 - Number of patent filings by the five key inventor locations. [source: Figure 6 of WIPO report "Hydrogen fuel cells in transportation"]

Inventors based in Japan have contributed to the highest number of cumulative patent filings by some margin. However, inventors based in China have been contributing to a significant recent increase in the number of active portfolios, with a particular interest in road-related applications. The number of active portfolios is also seen to be surging up. The data is again indicative that inventors based in the five key regions of China, Japan, Germany, Republic of Korea, and the United States are significantly contributing to fuel cell development on a global scale.

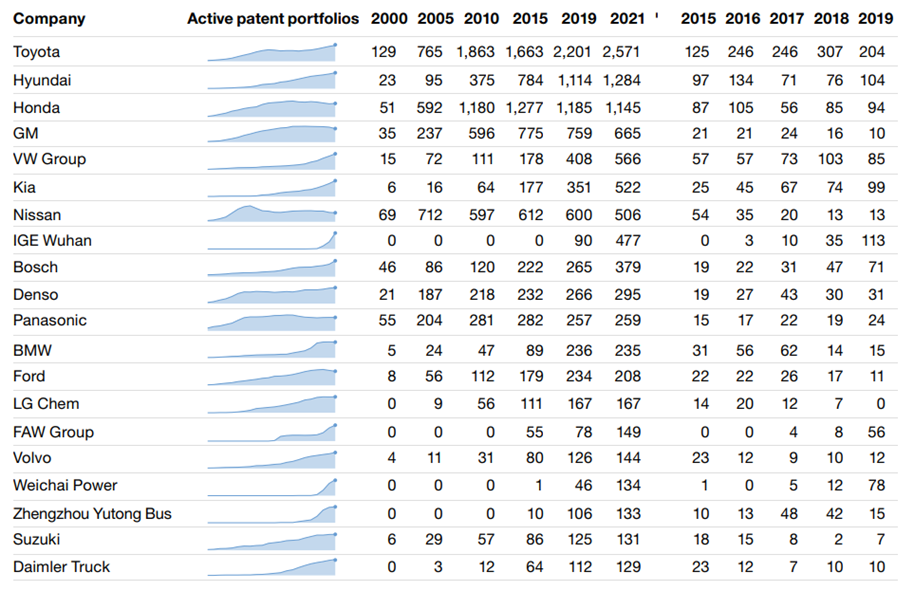

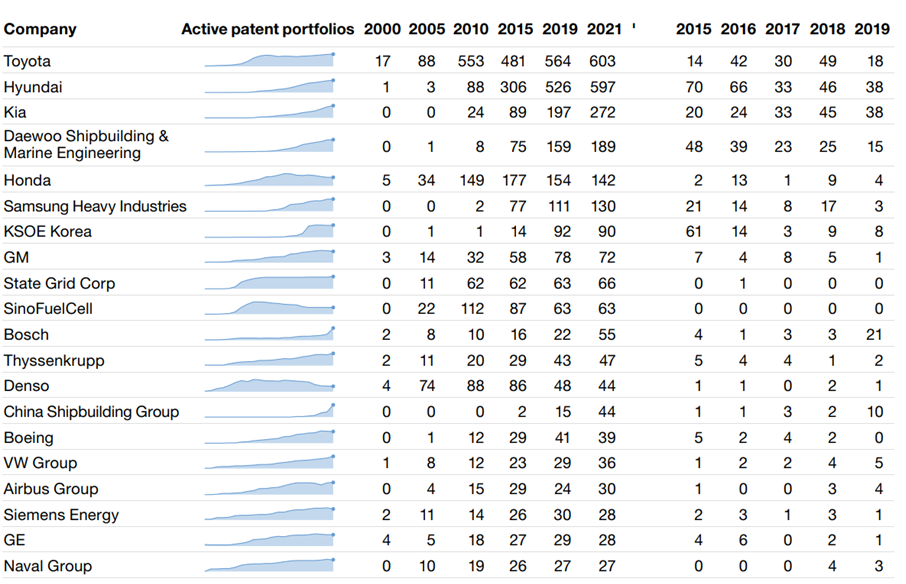

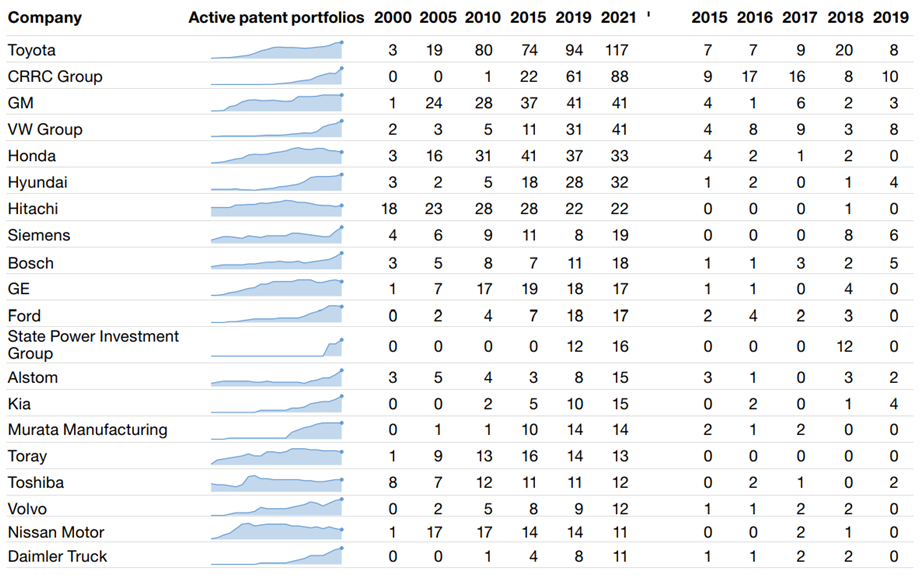

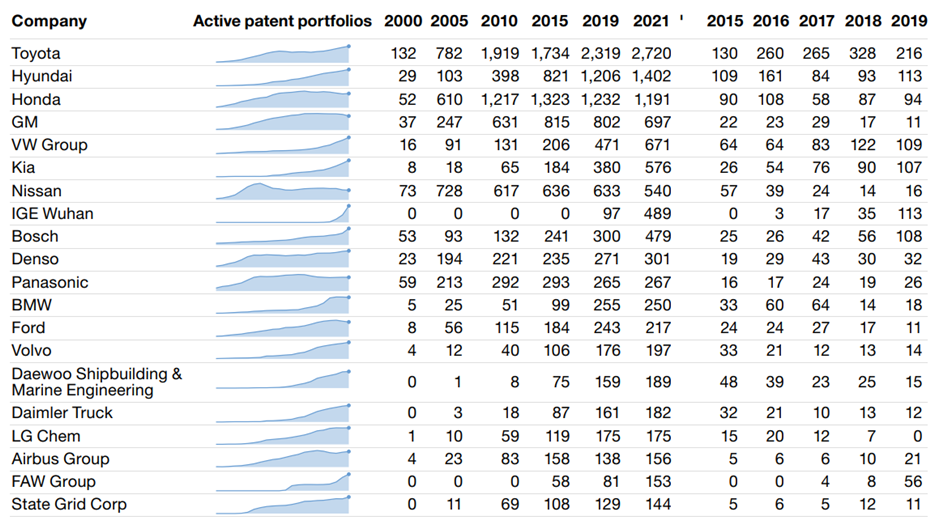

Figures 5-8 are the relevant data of the 20 applicants who have applied for the most patents in different sub-transport fields according to the statistics of WIPO. The top 20 are displayed according to the order: top 20 applicants for fuel cell patent filings in transport; top 20 applicants for fuel cell patent filings in road-related transport application; top 20 applicants for fuel cell patent filings in shipping transport applications; and finally, the top 20 applicants for fuel cell patent filings in rail and track vehicle subsector. It is observed that the top 20 applicants are dominated by automotive manufacturers primarily, mainly Toyota, Hyundai, Honda, General Motors, VW Group, and others. With Toyota being the top one in almost every detailed sector, while having twice the number of active patent portfolios than the runner-up companies. The vast majority of the top 20 applicants have an upward trend in the number of active fuel cell patents in recent years.

Figure 5 - Top 20 applicants for fuel cell patent filings in transport [source: Table 2 of WIPO report "Hydrogen fuel cells in transportation"]

Figure 6 - Top 20 applicants for fuel cell patent filings in road-related transport applications [source: Table 4 of WIPO report "Hydrogen fuel cells in transportation"]

Figure 7 - Top 20 applicants for fuel cell patent filings in shipping transport applications [source: Table 5 of WIPO report "Hydrogen fuel cells in transportation"]

Figure 8 - Top 20 applicants for fuel cell patent filings in rail and track vehicle subsector [source: Table 7 of WIPO report "Hydrogen fuel cells in transportation"]

In conclusion, hydrogen represents a promising option for replacing more conventional fossil fuels in at least some transportation sectors. The patent development that mentioned above demonstrates clearly that we are in the middle of the market development of a technically advanced technology. Almost all companies that is related to this industry match the patent landscape perfectly, in the form of strategic decision either to fully embrace the technology or simply walk away, though, we can see that even companies that encounter such a choice will choose not to stop research and patent application work in this industry, which reflected on their continued related patenting activity.

Patents are usually considered as highlighting the near future, with inventions typically having a timeline of between two and five years from invention filing to market entrance, depending on the technology. Market and business strategies aim for success within the next one to two years and are often two to three years ahead of the patent strategy. As a result, and from what we can tell from the analysis of patent development and news on fuel cells in transportation, we might see remarkable development in the very near future. However, in the view of the late-stage development of the technology and its high degree of maturity, WIPO analysis believes that factors such as infrastructure, political decision-making and global uncertainties leave us unsure about when will this going to happen. One thing is certain, though, according to the World Intellectual Property Organization (WIPO) Hydrogen fuel Cells in Transportation report, when it comes to the decarbonization of one of the largest climate gas contributors, namely, the transportation of goods or people, there are very few realistic options other than hydrogen in the long term.

World Intellectual Property Organization (WIPO). (2022). Patent landscape report: Hydrogen fuel cells in transportation.

World Intellectual Property Organization (WIPO). (2022). Patent Data Lexis Nexis PatentSight up to March 2022.

Clark, M. (2022, September 6). A review of patenting trends of hydrogen fuel cells in the transport sector. The International Intellectual Property Experts. Retrieved September 16, 2022, from https://www.marks-clerk.com/insights/articles/a-review-of-patenting-trends-of-hydrogen-fuel-cells-in-the-transport-sector/